Facts About Offshore Business Formation Revealed

Table of ContentsGet This Report on Offshore Business FormationAll about Offshore Business FormationOffshore Business Formation Things To Know Before You BuyThe 7-Second Trick For Offshore Business FormationSome Known Details About Offshore Business Formation

It is additionally worth keeping in mind that Hong Kong is ruled out a 'tax obligation place', and also will certainly not be impacted by the (as it is currently over the minimum). Hong Kong's tax system does not have any type of indirect taxes such as the Valued-Added Tax Obligation (VAT) or Item and also Services Tax (GST), such as those that use in the UK, the European Union, Australia, or New Zealand.

Offshore Business Formation Fundamentals Explained

Once the Hong Kong overseas firm is incorporated you will receive from the Business Computer registry. When it comes to, you must register within one month from the unification of your new Hong Kong offshore business - offshore business formation. Currently the Inland Income Division has established the "One-stop business as well as company enrollment solution", when an applicant provides the consolidation develops with the Business Windows registry will be taken into consideration to have actually made the application for business Registration certification at the exact same time, conserving time for applicants.

The city has a wide array of solution companies between typical financial, virtual financial institutions, and also repayment remedies that can supply a local corporate savings account or company represent business incorporated locally. Nevertheless, each institution has a details niche of the marketplace they offer and also inner needs for account application that can differ from one establishment to another.

If you wish to get more information about the procedure of how to, You can visit our page concerning to discover more concerning the process of how to open up a service account and also understand even more concerning the various choices readily available for overseas firms - offshore business formation. It is really usual to perplex the term overseas business in Hong Kong.

Not known Factual Statements About Offshore Business Formation

It is commonly taken into consideration that the simple reality of integrating a firm from another location will give the firm in view it now Hong Kong the automatic right to be classified as an overseas company by the Inland Profits Department and have accessibility to the Revenue Tax obligation rate of 0%. offshore business formation. When offering a case to the Inland Profits Department business have to confirm their income comes from jurisdictions beyond Hong Kong.

For instance, a company doing international service sourcing in China and also selling overseas. Is really common that Chinese providers invoice to the Hong Kong firm through another company in Hong Kong, in this instance, the resource of the income could be thought about from Hong Kong and the business more than likely will not be granted the offshore condition.

In some circumstances there may be benefits in scheduling offshore company formation as well as share problems for your firm. Morgan Reach can assist with offshore formation services as well as share problems in numerous areas and also can also assist with offshore banking and also renewals. There are 2 primary reasons to develop an Offshore Company, Tax obligation advantages, as well as legal security.

The Main Principles Of Offshore Business Formation

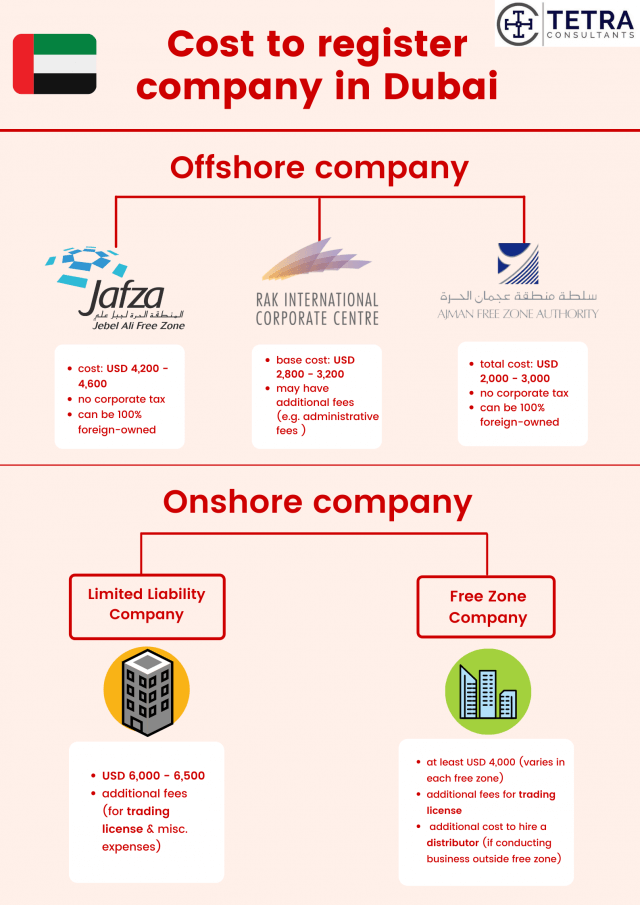

Being among the quickest creating on the globe and demonstrated to be perhaps the most effective place to begin a service, an offshore firm development in UAE accommodates all basic and also drove politeness for a business. offshore business formation. An overseas company development in Dubai can be asserted by individuals or corporate bodies and is an organization element that does not complete any type of considerable organization movement in its nation of beginning.

Such a firm is surrounded under the no-tax jurisdiction law with the sole factor for enhancing one's riches the board as well as lowering any sort of tax installation legally. There are a few explanations behind offshore firms signing up with UAE, with the vital one being ended up secrecy over the economic issues as well as increment in treasures without interference.

Offshore Business Formation Fundamentals Explained

This exchange tax can be effectively kept a critical distance from selling the company itself. Not many home designers around the world consider extra than a solitary landowner. go to these guys In case of an overseas company in UAE, however, the variety of investors can be 1-50, and also the business possesses the property.